UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

AMERICAN WOODMARK

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-ll(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

3102 Shawnee Drive

Winchester, Virginia 22601

Notice of Annual Meeting of Shareholders

TO THE SHAREHOLDERS OF

AMERICAN WOODMARK CORPORATION:

The Annual Meeting of Shareholders (“Annual Meeting”) of American Woodmark Corporation (the “Company”) will be held at the Hampton Inn Conference Center at 1204 Berryville Avenue,Museum of the Shenandoah Valley, 901 Amherst Street, Winchester, Virginia, on Thursday, August 26, 2004,25, 2005, at 9:00 a.m., Eastern Daylight Time, for the following purposes:

| 1. | To elect |

| 2. | To ratify the selection by the Board of Directors of KPMG LLP as independent registered public accounting firm of the Company for the fiscal year ending April 30, |

| 3. | To consider and vote upon the Company’s |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournments thereof. |

Only shareholders of record of shares of the Company’s common stock at the close of business on June 28, 200427, 2005 will be entitled to vote at the Annual Meeting or any adjournments thereof.

Regardless of whether or not you plan to attend the Annual Meeting, please complete the enclosed proxy, including signature and date, and promptly return it in the enclosed envelope. If for any reason you desire to revoke your proxy, you may do so at anytime before it is voted.

All shareholders are cordially invited to attend the Annual Meeting.

By Order of the Board of Directors |

|

| Secretary |

July 14, 20042005

AMERICAN WOODMARK CORPORATION

3102 Shawnee Drive

Winchester, Virginia 22601

Proxy Statement

Voting Rights, Procedures and Solicitation

Proxy Solicitation

This Proxy Statement, mailed to shareholders on or about July 16, 2004,15, 2005, is furnished in connection with the solicitation by American Woodmark Corporation (the “Company”) of proxies in the accompanying form for use at the Annual Meeting of Shareholders to be held on August 26, 2004,25, 2005, at 9:00 a.m., Eastern Daylight Time, and at any adjournments thereof. A copy of the annual report of the Company for the fiscal year ended April 30, 20042005 is being mailed to you with this Proxy Statement.

In addition to the solicitation of proxies by mail, the Company’s officers and other employees, without additional compensation, may solicit proxies by telephone, facsimile, and personal interview. The Company will bear the cost of all solicitation. The Company also will request brokerage houses and other custodians, nominees, and fiduciaries to forward soliciting material to the beneficial owners of Common Stockcommon stock held of record date by those parties and will reimburse those parties for their expenses in forwarding soliciting material.

Record Date and Voting Rights

On June 28, 2004,27, 2005, the record date for determining the shareholders entitled to vote at the Annual Meeting, there were 8,228,61016,404,102 shares of common stock of the Company outstanding and entitled to vote. Each such share of common stock entitles the holder thereof to one vote.

Revocability and Voting of Proxy

A form of proxy for use at the Annual Meeting and a return envelope for the proxy are enclosed. Any shareholder who provides a proxy may revoke such proxy at any time before it is voted. Proxies may be revoked by filing with the Secretary of the Company written notice of revocation which bears a later date than the date of the proxy, by duly executing and filing with the Secretary of the Company a later dated proxy relating to the same shares or, by attending the Annual Meeting and voting in person.

Votes will be tabulated by one or more inspectors of election. A proxy, if executed and not revoked, will be voted for the election of the nominees for director named herein; for the ratification of KPMG LLP as independent registered public accounting firm of the Company for fiscal year 2005;2006; and for the adoption of the Company’s 20042005 Non-Employee Directors Stock IncentiveOption Plan for Employees unless otherwise specified by the shareholder.

A majority of the total votes entitled to be cast on matters to be considered at the Annual Meeting constitutes a quorum. If a share is represented for any purpose at the Annual Meeting, it is deemed to be present for quorum purposes and for all other matters as well. Abstentions and shares held of record by a broker or its nominee (“Broker Shares”) that are voted on any matter are included in determining the number of votes present or represented at the Annual Meeting. However, Broker Shares that are not voted on any matter at the Annual Meeting will not be included in determining whether a quorum is present at such meeting.

The election of each nominee for director requires the affirmative vote of the holders of shares representing a plurality of the votes cast in the election of directors. Votes that are withheld and Broker Shares that are not voted in the election of directors will not be included in determining the number of votes cast and, therefore, will have no effect on the election of directors. Actions on all other matters to come before the meeting will be approved if the votes cast in favor of the action exceed the votes cast against it. Abstentions and Broker Shares that are not voted are not considered cast either for or against a matter and, therefore, will have no effect on the outcome.

-2--1-

ITEM 1 - ELECTION OF DIRECTORS

The Board, currently comprised of nineeleven members, has nominated nineeleven persons for election as directors. Unless otherwise specified, the enclosed proxy will be voted in favor of the persons named below to serve until the next annual meeting and until their successors are elected and qualified. Each of the nominees listed below is presently a director of the Company and, with the exception of Mr. Hendrix and Ms. Moerdyk, was elected by shareholders at the last Annual Meeting for a term expiring at the 20042005 Annual Meeting. Mr. C. Anthony Wainwright is not included for reelection due to his death in October 2003.

Although the Company anticipates all of the nominees named below will be able to serve, if at the time of the Annual Meeting any nominees are unable or unwilling to serve, shares represented by properly executed proxies will be voted at the discretion of the persons named therein for such other person or persons as the Board of Directors may designate.

NOMINEES

Name | Age | Principal Occupation(s) During the Last Five Years and Directorship(s) in Public Companies | Director of Company Since | Age | Principal Occupation(s) During the Last Five Years and Directorship(s) in Public Companies | Director of Company Since | ||||||

William F. Brandt, Jr. | 58 | Company Chairman and Executive Officer from 1996 to present | 1980 | 59 | Company Chairman and Executive Officer from 1996 to 2004 | 1980 | ||||||

Daniel T. Carroll | 78 | Chairman from 1995 to present of the Carroll Group, Inc. (a management consulting firm); Director, Woodhead Industries, Inc. and Oshkosh Truck Corp. | 1986 | 79 | Chairman from 1995 to present of the Carroll Group (a management consulting firm) | 1986 | ||||||

James J. Gosa | 57 | Company President and Chief Executive Officer from 1996 to present | 1995 | 58 | Company Chairman from 2004 to present; Company President and Chief Executive Officer from 1996 to present | 1995 | ||||||

Martha M. Dally | 53 | Chief Customer Officer June 2003 to present; Senior Vice President from May 2002 to June 2003, Business Development, Sara Lee Apparel, Europe; Vice President from August 2001 to May 2002 of Target Customer Business Team; Executive Vice President, Personal Products from 1994 to August 2001 of Sara Lee Corporation (a manufacturer and marketer of consumer products) | 1995 | 54 | Chief Customer Officer June 2003 to present; Senior Vice President Business Development, from May 2002 to June 2003, Sara Lee Apparel, Europe; Vice President from August 2001 to May 2002 of Target Customer Business Team; Executive Vice President, Personal Products from 1994 to August 2001 of Sara Lee Corporation (a manufacturer and marketer of consumer products) | 1995 | ||||||

Kent B. Guichard | 48 | Company Executive Vice President from May 2004 to present; Senior Vice President and Chief Financial Officer from 1999 to April 2004; Corporate Secretary from 1997 to present | 1997 | 49 | Company Executive Vice President from May 2004 to present; Senior Vice President and Chief Financial Officer from 1999 to April 2004; Corporate Secretary from 1997 to February 2005 | 1997 | ||||||

Kent J. Hussey | 58 | President and Chief Operating Officer from 1998 to present of Rayovac Corporation (a manufacturing company); Director, Rayovac Corporation | 1999 | 59 | President and Chief Operating Officer from 1998 to present of Spectrum Brands, Inc. (a manufacturing company – formerly Rayovac); Director, Spectrum Brands, Inc. | 1999 | ||||||

James G. Davis | 45 | President and Chief Executive Officer from June 1979 to present of James G. Davis Construction Corporation (a commercial general contractor) | 2002 | 46 | President and Chief Executive Officer from June 1979 to present of James G. Davis Construction Corporation (a commercial general contractor) | 2002 |

-2-

Name | Age | Principal Occupation(s) During the Last Five Years and Directorship(s) in Public Companies | Director of Company Since | |||

| G. Thomas McKane | 61 | Chairman and Chief Executive Officer from January 2004 to present; President and Chief Executive Officer from May 2000 to January 2004 of A.M. Castle & Company (specialty metal wholesaler); Senior Vice President Emerson Company October 1998 to May 2000; Director, A.M. Castle & Co. and Woodhead Industries, Inc. | 2003 | |||

| Neil P. DeFeo | 59 | President and Chief Executive Officer from 2004 to present of Playtex (a manufacturer); President and Chief Executive Officer from 1997 to 2003 of Remington Products Company (a manufacturer of small electric appliances); Director, Spectrum Brands, Inc. (a manufacturing company) | 2003 | |||

| Daniel T. Hendrix | 50 | President and Chief Executive Officer from 2001 to present; Executive Vice President from 2000 to 2001; Chief Financial Officer from 1986 to 2001 of Interface Inc. (a manufacturing company); Director, Interface, Inc. and Global Imaging Systems, Inc. (a technology service company) | 2005 | |||

| Carol B. Moerdyk | 55 | Senior Vice President, International from 2004 to present; Senior Vice President, Administration, from 2003 to 2004 of OfficeMax Incorporated (formerly Boise Cascade); Senior Vice President, Operations from 1998 to 2003 of Boise Cascade Office Products (a retailer); Director, Libbey, Inc. (a manufacturer) | 2005 | |||

-3-

Name | Age | Principal Occupation(s) During the Last Five Years and Directorship(s) in Public Companies | Director of Company Since | |||

G. Thomas McKane | 60 | Chairman and CEO from January 2004 to present; President and Chief Executive Officer from May 2000 to January 2004 of A.M. Castle & Company (specialty metal wholesaler); Senior Vice President Emerson Company October 1998 to May 2000; Director, A.M. Castle & Co. and Woodhead Industries, Inc. | 2003 | |||

Neil P. DeFeo | 58 | President and Chief Executive Officer from 1997 to 2003 of Remington Products Company (a manufacturer of small electric appliances); Director, Cluett America (a textile manufacturer) and Rayovac Corporation (a manufacturing company) | 2003 | |||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding shares of common stock beneficially owned as of June 28, 200410, 2005 by (i) each person who is known by the Company to beneficially own more than five percent of the outstanding shares of common stock, (ii) each director and director nominee of the Company, (iii) each named executive officer (as identified in the Compensation of Executive Officers section of this proxy statement under the heading “Summary Compensation Table”), and (iv) the directors and executive officers as a group. Unless otherwise noted, and to the best knowledge of the Company, each of the shareholders listed below has sole voting power and sole investment power with respect to the number of shares set forth opposite the shareholder’s name. The addresses of the shareholders listed below who own more than five percent of the outstanding shares of common stock are: Mr. William F. Brandt, Jr., 3102 Shawnee Drive,145 Creekside Lane, Winchester, VA 22601; Ms. Mary Jo Stout, PO Box 60, Mayville, MI 48744; Royce & Associates, LLC, 1414 Avenue of Americas, New York, NY 10019; and Columbia Wanger Asset Management, LP, 227 West Monroe Street – Suite 3000, Chicago, IL 60606-5016; and Royce & Associates, LLC, 1414 Avenue of America, New York, NY 10019.60606-5016.

Name | Number of Shares Beneficially Owned | Aggregate Percent of Class | |||

William F. Brandt, Jr.(1) | 1,971,483 | 24.0 | % | ||

Mary Jo Stout(2) | 768,036 | 9.3 | % | ||

Columbia Wanger Asset Management, LP(3) | 609,000 | 7.4 | % | ||

Royce & Associates, LLC(4) | 531,094 | 6.5 | % | ||

James J. Gosa(5) | 315,622 | 3.8 | % | ||

David L. Blount(6) | 154,059 | 1.9 | % | ||

Ian J. Sole(7) | 59,237 | * | |||

Kent B. Guichard(8) | 52,820 | * | |||

Daniel T. Carroll(9) | 13,764 | * | |||

Martha M. Dally(10) | 7,300 | * | |||

Neil P. DeFeo | 5,000 | * | |||

Fred S. Grunewald(11) | 2,642 | * | |||

Kent J. Hussey(12) | 2,000 | * |

-4-

Name | Number of Shares Beneficially Owned | Aggregate Percent of Class | |||

C. Anthony Wainwright(13) | 666 | * | |||

G. Thomas McKane | 700 | * | |||

James G. Davis(14) | 673 | * | |||

All directors and executive officers as a group (11 persons)(15) | 2,583,324 | 31.4 | % |

Name | Number of Shares Beneficially Owned | Aggregate Percent of Class | |||

William F. Brandt, Jr. (1) | 3,749,491 | 22.9 | % | ||

Mary Jo Stout (2) | 1,493,072 | 9.1 | % | ||

Royce & Associates, LLC (3) | 1,317,310 | 8.0 | % | ||

Columbia Wanger Asset Management, LP (4) | 1,112,000 | 6.8 | % | ||

James J. Gosa (5) | 633,410 | 3.9 | % | ||

David L. Blount (6) | 262,510 | 1.6 | % | ||

Kent B. Guichard (7) | 124,143 | * | |||

Ian J. Sole (8) | 108,613 | * | |||

Daniel T. Carroll (9) | 28,523 | * | |||

Martha M. Dally (10) | 16,599 | * | |||

Neil P. DeFeo (11) | 10,666 | * | |||

Kent J. Hussey (12) | 5,999 | * | |||

James G. Davis (13) | 3,129 | * | |||

G. Thomas McKane (14) | 2,066 | * | |||

Jonathan H. Wolk | 1,500 | * | |||

Carol B. Moerdyk | — | * | |||

Daniel T. Hendrix | — | * | |||

All directors and executive officers as a group (14 persons) (15) | 4,946,649 | 30.2 | % | ||

| * | Indicates less than 1%. |

| (1) | Includes |

| (2) | Includes |

| (3) |

| The beneficial ownership information for Royce & Associates, LLC is based upon the Schedule 13F-HR filed with the SEC on May |

| The beneficial ownership information for Columbia Wanger Asset Management, LP is based upon the Schedule 13F-HR filed with the SEC on April 13, 2005. Columbia Wanger Asset Management, LP has shared voting and dispositive powers with respect to 1,112,000 shares. |

| (5) | Includes stock options exercisable on June |

| (6) | Includes |

-4-

| (7) | Includes stock options exercisable on June |

| (8) | Includes stock options exercisable on June 10, 2005 or within 60 days thereafter by Mr. Sole for |

| Includes stock options exercisable on June |

| (10) | Includes |

| (11) |

| Includes stock options exercisable on June |

| (12) | Includes stock options exercisable on June 10, 2005 or within 60 days thereafter by Mr. Hussey for |

-5-

| Includes stock options exercisable on June |

| Includes stock options exercisable on June |

| (15) | Includes stock options exercisable on June 10, 2005 or within 60 days thereafter for an aggregate of |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and officers, and persons who beneficially own more than ten percent of a registered class of the Company’s equity securities (including common stock), to file with the Securities and Exchange Commission (“SEC”) initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors, and greater than ten percent beneficial owners are required by SEC rules to furnish the Company with copies of all Section 16(a) reports they file with the SEC.

Based solely upon a review of Forms 3, 4, and 5 (and amendments thereto) furnished to us during or in respect of the fiscal year ended April 30, 2004,2005, we are not aware of any director, executive officer or greater than 10% holder who has not timely filed reports required by Section 16(a) of the Exchange Act during or in respect of such fiscal year, except for the inadvertent late Form 4 reporting by Mr. GosaDavis of 220a 450 share purchase on 12/07/04; the inadvertent late Form 4 reporting by Mr. Blount of a 10,000 share sale on 2/28/02, and a 5,000 share sale on 3/4/02. Due to an inadvertent administrative error on the Company’s behalf, replacement stock option grants for Mr. Blount, dated 3/30/04 in the amount of 18,789 shares; Mr. Brandt, dated 4/28/04 in the amount of 12,949 shares; and Glenn Eanes, dated 2/27/04 in the amount of 1,200 shares, gifted on 12/30/97, 350 shares gifted on 10/25/00, and 460 shares gifted on 12/21/01. The Form 4were not reported timely. All respective transactions have been reported on Form 5.4.

-5-

CERTAIN INFORMATION CONCERNING THE

BOARD OF DIRECTORS AND ITS COMMITTEES

Board Independence

On an annual basis the Board reviews the independence of all directors and affirmatively makes a determination as to the independence of each director. The Board adopted an independence standard which complies with Rule 4200(a)(15) of the NASDAQ corporate governance listing standards and determined that a majority of its directors are independent within the meaning of independence standards as set forth by Rule 4200(a)(15) of the NASDAQ Corporate Governance Listing Standards and with all subsequent requirements as amended. The independent directors are: Mr. Carroll, Mr. Hussey, Ms. Dally, Mr. Davis, Mr. DeFeo, Mr. Hendrix, Mr. Hussey, Mr. McKane, and Mr. McKane.Ms. Moerdyk.

Communication with the Board of Directors

Any shareholder wishing to contact the Board of Directors, the independent directors as a group, or any individual director may do so in writing by sending a self-addressed, stamped letter to:

Chairman, Nominating and Governance Committee

c/o Corporate Secretary

American Woodmark Corporation

3102 Shawnee Drive

Winchester, Virginia 22601

The Corporate Secretary will review all such written correspondence and forward to the Committee a summary of all correspondence that deals with the functions of the Board or its committees or that the Corporate Secretary otherwise determines requires the attention of the Committee.

-6-

The Committee will review and regularly provide the Board of Directors with a summary of the communications received from shareholders and the actions taken or recommended to be taken if it requires approval of the full Board as a result of such communications. Directors may, at any time, review a log of all correspondence received by the Company which is addressed to members of the Board and may request copies of any such correspondence.

Board and Committee Meetings

The Board of Directors held sixfive regular meetings during the fiscal year ended April 30, 2004.2005. The Board of Directors has a Compensation Committee, an Audit Committee, and a Nominating and Governance Committee. During fiscal year 20042005 all of the Board members attended at least 75% of the total number of Board meetings and meetings of all committees of the Board held during periods which they were members of the Board or such committees, except for Mr. Wainwright who, due to his death, attended 50% and Mr. DeFeo who attended 67% of Board and committee meetings.committees. Independent directors meet on a regular basis without the management directors present to discuss a variety of matters regarding the Company’s performance and operations. The Board of Directors believes that attendance at American Woodmark Corporation’s Annual Meeting of Shareholders demonstrates a commitment to the Company, responsibility and accountability to the shareholders, and support of management and employees. Therefore, it is a policy of the Board that all members attend the Annual Meeting of Shareholders. All members of the Board attended last year’s Annual Meeting of Shareholders, except for Mr. Wainwright.Shareholders.

Compensation Committee

The Compensation Committee is composed of Ms. Dally, Mr. Davis, Mr. DeFeo, and Mr. DeFeo. Ms. DallyHendrix. Mr. Davis serves as Chairperson of the Compensation Committee. The Compensation Committee adopted an independence standard which complies with the independence requirements of the NASDAQ corporate governance listing standards. All members have been determined by the Board of Directors to be “independent” and meet the independence requirements of the NASDAQ listing standards. The Compensation Committee determines awards under and administers the Company’s 1996 and 1999 Stock Option Plans for Employees, the

-6-

2004 Stock Incentive Plan for Employees, and the Company’s Shareholder Value Plan for Employees. The Committee also reviews the compensation of executive officers of the Company. The Compensation Committee met fourfive times during fiscal year 2004.2005. The Board of Directors has adopted a charter for the Committee which is available at www.americanwoodmark.com.

Audit Committee

The Audit Committee is composed of Mr. Hussey, Mr. Carroll, Mr. McKane, and Mr. McKane.Ms. Moerdyk. Mr. Hussey serves as the Chairperson of the Audit Committee. All members have been determined by the Board of Directors to be “independent” and meet the Audit Committee independence requirements of the NASDAQ listing standards. At least one member must be an “audit committee financial expert” and have accounting or related financial management expertise as required by the SEC. The Board of Directors has determined that all of the current members of the Audit Committee satisfy the requirements of a “financial expert” within the meaning of the SEC rules, and has identified that each member is considered a “financial expert”. The Audit Committee reviews and reports to the Board with respect to various auditing and accounting matters, including the selection and fees of the Company’s independent auditors,registered public accounting firm, the scope of both internal and independent audit procedures, the nature of services to be performed by the independent auditors,registered public accounting firm, and the Company’s accounting practices. The Audit Committee is governed by a written charter approved by the Board of Directors. A copy of this charter is included in Appendix A. The Audit Committee met fourfive times during fiscal year 2004.2005.

Nominating and Governance Committee

The Nominating and Governance Committee is composed of Ms. Dally, Mr. Carroll, Mr. Hussey, and Mr. DeFeo. Mr. CarrollMs. Dally serves as Chairperson of the Committee. The Nominating and Governance Committee adopted an independence standard which complies with the independence requirements of the NASDAQ corporate governance listing standards. All members have been determined by the Board to be “independent” and meet the independence requirements of the NASDAQ listing standards. The Nominating and Governance Committee is

-7-

responsible for recruiting and nominating new directors, appointing committees and chairs, reviewing the performance of each director a minimum of once every three years, reviewing the performance of the Board, and exploring ways to improve the effectiveness of the Board. The Committee met threefour times during fiscal year 2004.2005. The Board of Directors has adopted a charter for the Committee which is available at www.americanwoodmark.com.

The Nominating and Governance Committee will consider recommendations for directorships submitted by shareholders. Shareholders who wish the Nominating and Governance Committee to consider their recommendations for nominees for the position of Director should submit their recommendations in writing to the Committee in care of the Office of the Secretary, American Woodmark Corporation, PO Box 1980, Winchester, VA 22604. Correspondence must be received by the Company not less than 150 days prior to the anniversary date of the Company’s most recent annual meeting of shareholders and must include a copy of the candidate’s resume, the candidate’s contact information, and the written consent of the candidate to serve as a Director of the Company. The Nominating and Governance Committee may subsequently request additional information regarding the candidate. Recommendations by shareholders that are made in accordance with these procedures will receive the same consideration given to nominees of the Nominating and Governance Committee.

The Nominating and Governance Committee considers candidate’s recommended by current members of the Board of Directors, members of management, and shareholders. From time to time, the Committee may engage an independent firm to assist in identifying potential candidates. During the Company’s fiscal year 2005, an independent search firm was engaged in identifying Ms. Moerdyk and Mr. Hendrix as candidates.

In its assessment of each candidate, the Nominating and Governance Committee will review the candidate’s judgement, business experience, independence, understanding of the Company’s or other related industries and other factors deemed pertinent in light of the current needs of the Board.

-7-

Corporate Governance

The Board of Directors has adopted a Code of Business Conduct and Ethics for directors, officers and employees of American Woodmark Corporation. Additionally, the Board has adopted a Code of Business Conduct and Ethics for the Chief Executive Officer and Senior Financial Officers. Each code sets forth and summarizes certain policies of the Company related to legal compliance and ethical business practices. The codes are intended to comply with the listing standards as set forth by NASDAQ. Any amendments to, or waivers from any provisions that apply to our directors or executive officers, including our Chief Executive Officer, Chief Financial Officer, Controller, and Treasurer, will be promptly posted on our Web site at www.americanwoodmark.com. No amendments or waivers were requested or granted during the year ended April 30, 2004.2005.

You can find links to both Codes of Business Conduct and Ethics at the Company’s Web site www.americanwoodmark.com.

Report of the Audit Committee

The Audit Committee is composed of independent directors as defined by Rule 4200(a)(15) of the listing standards of the National Association of Securities Dealers. The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the Committee reviewed the audited financial statements in the Annual Report with management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Committee reviewed with the independent auditors,registered public accounting firm, who are responsible for expressing an opinion on the conformity of those audited financial statements with accounting principlesU.S. generally accepted in the United States,accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Committee under auditing standards generally accepted in the United States. In addition, the Committee has discussed with the independent auditorsregistered public accounting firm the auditors’ independence from management and the Company, including the matters in the written disclosures required by the Independence Standards Board, and considered the compatibility of non-audit services with the auditors’ independence.

The Committee discussed with both the Company’s internal auditor and the independent auditorsregistered public accounting firm the overall scope and plans for their respective audits. The Committee meets with the internal auditor and the independent auditors,registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

The Committee reviewed and discussed the requirements of, and the Company’s progress on complying with, Section 404 of the Sarbanes-Oxley Act of 2002, including the Public Company Accounting Oversight Board’s (PCAOB) Auditing Standard No. 2 regarding the audit of internal control over financial accounting.

In reliance on the reviews and discussions referred to above, the Committee has approved that the audited financial statements be included in the Annual Report on Form 10-K for the year ended April 30, 20042005 for filing with the Securities and Exchange Commission. The Committee and the Board have also recommended, subject to shareholder approval, the selection of KPMG LLP as the Company’s independent registered public accounting firm for fiscal 2005.2006.

Kent J. Hussey, Chairperson

Daniel T. Carroll

G. Thomas McKane

Carol B. Moerdyk

June 18, 200413, 2005

-8-

Compensation of the Board

Non-employee directors receive an annual retainer of $21,250. Directors who are also employees of the Company do not receive any compensation for their membership on the Board. The Company bears the cost of all travel expenses associated with each director’s performance of his or her responsibilities.

In August 2000 shareholders approved the 2000 Non-Employee Directors Stock Option Plan (the “2000 Directors Plan”). The 2000 Directors Plan replacesreplaced the 1995 Non-Employee Directors Stock Option Plan which expired August 31, 1999. Each non-employee director automatically receives upon his or her initial election by shareholders to the Board an option to acquire 1,0002,000 shares of common stock under the Company’s 2000 Directors Plan. Each year thereafter, eligible directors are automatically granted an option to acquire an additional 1,0002,000 shares of common stock. The exercise price for each option granted under the 2000 Directors Plan is 100% of the fair market value of common stock on the date of the grant. Options granted under the 2000 Directors Plan have a term of four years and are exercisable as to one-third of the shares on the first anniversary of the date of grant and as to an additional one-third on each succeeding anniversary of the date of grant. During the last fiscal year, Messrs. Brandt, Carroll, Wainwright, Hussey, Davis, McKane, DeFeo, and Ms. Dally were each granted options to purchase 1,0002,000 shares at an exercise price of $50.98$33.995 per share.

Each non-employee director is also eligible to participate in the Company’s Shareholder Value Plan for Non-Employee Directors. The plan authorizes the Compensation Committee to grant “award units” to non-employee directors. Each unit awarded under the plan permits its holder to receive a cash payment if the Company’s total shareholder return for a three-year performance period, when expressed as a percentage and compared with the total shareholder return for an index (the “Index”) for that period, falls within a ranking scale between the 50th percentile and the 90th percentile of the companies in the Index. The Index applicable to each award is determined by the Compensation Committee at the time of the initial grant and may be the S&P Household Durables Index, the Russell 2000 Index or any other similar nationally recognized index which the Compensation Committee determines constitutes a group of companies comparable with the Company. Total shareholder return is defined as the increase in the average trading price of a share of common stock during the month in which the three-year performance period ends, divided by the average trading price of a share of common stock during the month preceding the first day of the three-year performance period, plus the value of dividends or other distributions with respect to a share of common stock during the performance period and expressed as an annualized rate of return for the performance period.

The Compensation Committee granted three award units to each of Messrs. Carroll, DeFeo, McKane, Hussey, Davis, and Ms. Dally for a performance period beginning on September 1, 20032004 and ending on August 31, 2006.2007. The Compensation Committee selected the Russell 2000 Index as the Index for comparing total shareholder return for the performance period. The Compensation Committee assigned a value of $500 for each award unit if the Company’s total shareholder return is at the 50th percentile ranking, a value of $3,000 if total shareholder return is at or greater than the 90th percentile ranking and intermediate values for rankings between the 50th and 90th percentiles. Therefore, if the Company’s total shareholder return for the performance period described above equals the 50th percentile of total shareholder return for the Index, the non-employee director will receive a payment of $1,500 (3 X $500) for the three-year performance period. If the Company’s percentile ranking is 91, the participant will receive a payment of $9,000 (3 X $3,000). If the Company’s percentile ranking is below the 50th percentile, no amount will be paid to the non-employee director.

Before any payment may be made, the Compensation Committee must certify the performance goal has been achieved and any other requirements of the plan have been satisfied. No payment will be made until the Compensation Committee makes the certification.

Payments under the Plan are made as soon as administratively practicable following the last day of the performance period. No payment will be made to a non-employee director if he or she ceases to be a director before the last day of the performance period for any reason other than death, disability, change of control, or liquidation of the Company. If the non-employee director ceases to be a director because of the occurrence of one of the preceding events, the non-employee director will receive a prorated payment. Three award units were previously granted under the plan in 20002001 to each of Messrs. Carroll, Wainright, Hussey, and Ms. Dally. The performance

-9-

performance period for these awards ended on August 31, 2003.2004. Because the Company’s total shareholder return for the performance period was greater than the 90th90th percentile for the Index applicable to the units, each director received a payment of $3,000 for each of their units, for a total payment of $9,000.

COMPENSATION OF EXECUTIVE OFFICERS

Summary Compensation Table

The following table sets forth the compensation for the Company’s named executive officers for the Company’s last three completed fiscal years. The named executive officers consist of the Chief Executive Officer and the four other most highly compensated executive officers of the Company as of April 30, 2004.2005.

| Annual Compensation | Long-Term Compensation | ||||||||||||||||||||

Name & Principal Position | Fiscal Year | Salary | Bonus | Other Annual Compensation(1) | Awards Securities | Payouts LTIP Payouts (2) | All Other Compensation | ||||||||||||||

James J. Gosa Chairman, President & Chief Executive Officer | 2005 2004 2003 | $ | 596,154 578,462 522,885 | $ | 473,525 531,012 510,818 | $ | 9,558 15,269 27,090 | (4) (4) | 200,000 80,000 80,000 | $ | — 300,000 300,000 | $ | 71,401 96,839 89,635 | (3) (3) (3) | |||||||

Kent B. Guichard Executive Vice President | 2005 2004 2003 | | 352,077 297,804 266,530 | | 249,142 262,424 241,340 | | 9,504 �� — | | 45,000 20,000 20,000 | | — 141,000 132,000 | | 31,199 43,298 33,044 | (5) (5) (5) | |||||||

David L. Blount Senior Vice President | 2005 2004 2003 | | 277,069 270,004 245,285 | | 182,442 236,886 215,258 | | 9,494 — 15,704 | (7) | 20,000 20,000 20,000 | | — 132,000 126,000 | | 37,494 57,254 51,153 | (6) (6) (6) | |||||||

Ian J. Sole Sr. Vice President, Sales & Marketing | 2005 2004 2003 | | 276,969 268,400 241,318 | | 224,858 236,797 219,237 | | 4,353 11,887 10,475 | (9) (9) | 20,000 20,000 20,000 | | — 129,000 117,000 | | 19,654 25,275 22,350 | (8) (8) (8) | |||||||

Jonathan H. Wolk Vice President and Chief Financial Officer | 2005 | 96,154 | 125,000 | — | 20,000 | — | 12,682 | (10) | |||||||||||||

| (1) | |||||||||||||||||||||

|

| ||||||||||||||||||||

|

| ||||||||||||||||||||

| |||||||||||||||||||||

| |||||||||||||||||||||

| |||||||||||||||||||||

| |||||||||||||||||||||

| |||||||||||||||||||||

| Includes amounts paid in connection with Company-paid spousal travel. |

| (2) | Amount paid in connection with award units granted to the named executive officer |

| (3) | Consists of Company contributions to the Investment Savings Stock Ownership Plan of $4,469, $4,220, $4,121; and Company contributions credited under the Pension Restoration Plan of $66,932, $92,619, and $85,514 for years ending April 30, 2005, 2004, and 2003, respectively. |

| (4) | Amount includes $6,144, and $18,117, and |

| Consists of Company contributions to the Investment Savings Stock Ownership Plan of $4,632, $4,220, |

| Consists of Company contributions to the Investment Savings Stock Ownership Plan of $4,028, $4,220, |

-10-

| Amount includes $13,333 |

-10-

| Consists of Company contributions to the Investment Savings Stock Ownership Plan of |

| Amount includes $2,762 and $756 for discounted cabinet purchases by Mr. Sole for the years ended April 30, 2004 and 2003, respectively. |

| Amount includes |

Option Grants in Last Fiscal Year

The following table sets forth information concerning options granted to the Company’s named executive officers under the 1999 Stock Option Plan and 2004 Stock Incentive Plan during the fiscal year ended on April 30, 2004.2005.

| Individual Grants(1) | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term(2) | Individual Grants (1) | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term (2) | |||||||||||||||||||||||||||

Name | Number of (#) | Percent of Total Options Granted to Employees in Fiscal Year (%) | Exercise or Base ($/Share) | Expiration Date | 5% ($) | 10% ($) | Number of (#) | Percent of Total Options Granted to Employees in Fiscal Year (%) | Exercise or Base ($/Share) | Expiration Date | 5% ($) | 10% ($) | ||||||||||||||||||

James J. Gosa | 40,000 | 22.7 | $ | 48.41 | 06/13/13 | $ | 1,217,600 | $ | 3,086,000 | 80,000 120,000 | 15.2 22.7 | $ | 26.85 30.625 | 06/15/14 08/20/14 | $ | 1,351,200 2,311,200 | $ | 3,423,200 5,857,200 | ||||||||||||

Kent B. Guichard | 10,000 | 5.7 | 48.41 | 06/13/13 | 304,400 | 771,500 | 45,000 | 8.5 | 26.85 | 06/15/14 | 760,050 | 1,925,550 | ||||||||||||||||||

David L. Blount | 10,000 | 5.7 | 48.41 | 06/13/13 | 304,400 | 771,500 | 20,000 | 3.8 | 26.85 | 06/15/14 | 337,800 | 855,800 | ||||||||||||||||||

Ian J. Sole | 10,000 | 5.7 | 48.41 | 06/13/13 | 304,400 | 771,500 | 20,000 | 3.8 | 26.85 | 06/15/14 | 337,800 | 855,800 | ||||||||||||||||||

William F. Brandt, Jr. | 7,000 | 4.0 | 48.41 | 06/13/13 | 213,080 | 540,050 | ||||||||||||||||||||||||

Jonathan H. Wolk | 20,000 | 3.8 | 42.17 | 12/13/14 | 530,400 | 1,344,200 | ||||||||||||||||||||||||

| The exercise price of each option is 100% of the fair market value of the Company’s common stock on the date of the option grant. Options are exercisable at a rate of 33.33% per year beginning on the first anniversary of the date on which the options were granted. The options must be exercised within ten years from the date of grant, at which time the options expire. If the employee’s employment is terminated for any reason other than death or disability, the employee has three months to exercise that portion of the option that was exercisable as of the date of his or her termination of employment. |

| (2) | Potential realizable value is calculated using a Black-Scholes model with an expected volatility of |

-11-

Aggregated Option Exercises in Last Fiscal Year and

Fiscal Year-End Option Values

The following table summarizes stock options exercised during the fiscal year ended April 30, 20042005 and presents the values of unexercised options held by the Company’s named executive officers at the end of that fiscal year.

Name | Shares Acquired On Exercise (#) | Value Realized ($) | Number of Securities Underlying Unexercised Options At FY-End (#) Exercisable / Unexercisable | Value of Unexercised In-the-Money Options At FY-End ($) Exercisable / Unexercisable | Shares Acquired On Exercise (#) | Value Realized ($) | Number of Securities Underlying Unexercised Options At FY-End (#) Exercisable / Unexercisable | Value of Unexercised In-the-Money Options At FY-End ($) Exercisable / Unexercisable | ||||||||||||

James J. Gosa | 34,200 | $ | 2,001,195 | 233,000/ 80,000 | $ | 8,697,922/ 1,100,088 | 136,000 | $ | 3,134,864 | 382,800/ 320,274 | $ | 6,306,100/ 1,155,800 | ||||||||

Kent B. Guichard | 10,000 | $ | 453,500 | 35,000/ 20,000 | | 1,130,045/ 275,022 | 10,000 | $ | 232,800 | 79,800/ 65,200 | | 1,016,480/ 326,859 | ||||||||

David L. Blount | 56,000 | $ | 2,435,538 | 10,000/ 38,789 | | 230,278/ 275,022 | 39,999 | $ | 854,483 | 25,847/ 76,869 | | 50,903/ 150,703 | ||||||||

Ian J. Sole | 10,000 | $ | 453,500 | 45,000/ 20,000 | | 1,476,445/ 275,022 | 30,000 | $ | 1,015,200 | 79,987/ 40,013 | | 938,040/ 201,597 | ||||||||

William F. Brandt, Jr. | 102,999 | $ | 4,783,803 | 4,668/ 22,282 | | 81,083/ 111,463 | ||||||||||||||

Jonathan H. Wolk. | — | — | 0/ 20,000 | | — / — | |||||||||||||||

Employment Agreements

The Company has entered into employment agreements with the following executives: Messrs. Gosa, Guichard, Blount, and Sole as described below.

Mr. Gosa has an employment agreement with the Company to fulfill the duties of President and Chief Executive Officer. The agreement provides Mr. Gosa a base salary of at least $500,000$610,000 per year, subject to annual upward adjustments, as the Company shall deem appropriate from time to time and as approved within general practice and authority levels required by the Company. Further, Mr. Gosa is entitled to participate in the Company’s annual incentive program with a bonus opportunity of between 0% and 110%150% of his then current base salary. The actual amount of the bonus will be related to achievement of certain performance objectives set by the Board of Directors at the beginning of each fiscal year. The initial term of the agreement endedwill end December 31, 2002. The agreement has been automatically extended for an additional one-year term ending December 31, 2004.2006. The agreement will be extended each subsequent year unless either party to the agreement gives notice on or before November 1st of the preceding year. If during the term of this agreement Mr. Gosa’s employment is terminated without cause (as defined in the agreement), he is entitled to severance pay equal to his base salary for a period of 18 months. Severance will be paid in accordance with the Company’s usual payroll practices for salaried personnel. The agreement provides that Mr. Gosa will not compete with the Company either while he is employed or during the time he receives severance pay. Should the Company undergo a change in control (as defined by the agreement), Mr. Gosa may terminate his employment at any time during the two-year period following the change of control. If Mr. Gosa exercises this right, he will receive a single lump sum equal to 2.99 times the sum of (1) the greater of his annual base salary at the time of termination or the largest base salary in effect during the term of this agreement, and (2) an amount equal to the greater of the average of bonuses paid for

-12-

the three preceding fiscal years or 60% of the maximum eligible annual cash bonus for the year of termination. Likewise, if the Company terminates Mr. Gosa’s employment without cause within three months before and two years after a change in control, he will receive the same severance package in a single lump sum. This agreement

-12-

may not be terminated for 24 months after a change in control. In no event, however, may a severance benefit paid after a change in control exceed the maximum that can be paid without such payment constituting excess parachute payments for purposes of the Internal Revenue Code.

Mr. Guichard has an employment agreement similar to Mr. Gosa’s employment agreement with the following differences. Mr. Guichard fulfills the duties of Executive Vice President. His annual compensation is at least $339,000$359,000 per year, subject to annual upward adjustments. Mr. Guichard is entitled to participate in the Company’s annual incentive program with a bonus opportunity of between 0% and 100%120% of his then current base salary.

Messrs. Blount and Sole also have employment agreements similar to Mr. Gosa’s employment agreement, with the following differences. Mr. Blount serves as Senior Vice President, Manufacturing and receives an annual base salary of at least $234,490, subject to annual upward adjustments. Mr. Sole serves as Senior Vice President, Sales and Marketing and receives an annual base salary of at least $230,585, subject to annual upward adjustments. Each is entitled to participate in the Company’s annual incentive program with a bonus opportunity of between 0% and 100% of his then current base salary. If during the term of his agreement either Mr. Blount or Mr. Sole is terminated without cause (as defined in their agreements), he will receive severance pay for a period of 12 months. The agreements provide they will not compete with the Company either while they are employed or during the time they receive severance pay. If either Mr. Blount or Mr. Sole terminates his employment for good reason within one year of a change in control, he will be entitled to severance pay in one lump sum. He has good reason to terminate his employment only if: (i) his base salary is reduced, (ii) he is not in good faith considered for a bonus, (iii) he is not in good faith considered for other executive compensation benefits, (iv) his place of employment is relocated to a location further than 50 miles from his current place of employment, or (v) his working conditions or management responsibilities are substantially diminished (other than on account of his disability). This severance package will be equal to two times the sum of (1) the greater of his annual base salary at the time of termination or the largest base salary in effect during the term of this agreement, and (2) an amount equal to the greater of the average of bonuses paid for the three preceding fiscal years or 60% of the maximum eligible annual cash bonus for the year of termination. Likewise, if the Company terminates either executive’s employment without cause within three months before and one year after a change in control, he will receive the same severance package in a single lump sum.

Long-Term Incentive Plan - Awards in Last Fiscal Year

The following table sets forth information concerning long-term incentives granted to the Company’s named executive officers under the Shareholder Value Plan for Employees (the “Shareholder Value Plan”) during the fiscal year ended April 30, 2004.2005.

Name | Number of Shareholder Value Plan (SVP) Units Awarded in Fiscal Year | Performance or Other Period Until Maturation or Payout | Estimated Future Payouts Under Non-Stock Price-Based Plans | |||||||||||||||||||||||

Number of Fiscal Year | Performance or Other or Payout | Estimated Future Payouts Under Non-Stock Price-Based Plans | ||||||||||||||||||||||||

Name | Number of Shareholder Value Plan (SVP) Units Awarded in Fiscal Year | Performance or Other Period Until Maturation or Payout | Threshold | Target | Maximum | Threshold | Target | Maximum | ||||||||||||||||||

| $ | 67,000 | $ | 261,300 | $ | 402,000 | 143 | 5/1/04 to 4/30/07 | $ | 71,500 | $ | 278,850 | $ | 429,000 | |||||||||||||

Kent B. Guichard | 55 | 5/1/03 to 4/30/06 | 27,500 | 107,250 | 165,000 | 68 | 5/1/04 to 4/30/07 | 34,000 | 132,600 | 204,000 | ||||||||||||||||

David L. Blount | 50 | 5/1/03 to 4/30/06 | 25,000 | 97,500 | 150,000 | 53 | 5/1/04 to 4/30/07 | 26,500 | 103,350 | 159,000 | ||||||||||||||||

Ian J. Sole | 49 | 5/1/03 to 4/30/06 | 24,500 | 95,550 | 147,000 | 53 | 5/1/04 to 4/30/07 | 26,500 | 103,350 | 159,000 | ||||||||||||||||

-13-

Each of the units awarded under the Shareholder Value Plan permits its holder to receive a cash payment if the Company’s total shareholder return for the three-year performance period beginning on May 1, 20032004 and ending on April 30, 2006,2007, when expressed as a percentage and compared with the total return for the Russell 2000 Index (the “Index”) for that period, falls within a ranking scale between the 50th50th percentile and 90th90th percentile of the companies in the Index. Total shareholder return for the Company is defined as the increase in the average trading price of a share of common stock during the month which ends the three-year performance period, divided by the average trading price of a share of common stock during the month preceding the first day of the three-year performance period, plus the value of dividends or other distributions with respect to a share of common stock during the performance period and expressed as an annualized rate of return for the performance period. The return on the Index is defined as the increase in the average Index value during the month which ends the three-year performance period, divided by the average Index value during the month preceding the first day of the three-year performance period.

The Compensation Committee has assigned a value of $500 for each award unit if the Company’s total shareholder return is at the 50th percentile ranking, a value of $3,000 if total shareholder return is at the 90th percentile ranking and intermediate values for rankings between the 50th and 90th percentiles. Therefore, if a participant has 50 award units and the Company’s total shareholder return is at the 50th percentile, the participant will receive incentive compensation of $25,000 (50 X $500) for the three-year performance period. If the Company’s return is twice the return on the Index, the participant will receive incentive compensation of $150,000 (50 X $3,000). If the Company’s return is below the 50th percentile, no incentive compensation will be paid to the participant.

Before any payment may be made, the Compensation Committee must certify the performance goal has been achieved and any other requirements of the plan have been satisfied. No payment will be made until the Compensation Committee makes that certification. The maximum aggregate amount a participant in the Shareholder Value Plan may be paid with respect to the award units listed in the table above is $750,000.

Award unit payments will be made as soon as administratively practicable following the last day of the performance period. No payments will be made to a participant if the participant’s employment terminates before the last day of the performance period for any reason other than death, disability, retirement or the sale or other disposition of the business unit in which the participant is employed. If termination of employment occurs because of the occurrence of one of the preceding events, the participant will receive a prorated payment.

Pension Plan

The Company maintains a non-contributory defined benefit pension plan. The plan covers substantially all employees who are compensated on the basis of a salary and/or a commission, and who meet certain age and service requirements. Funding is determined on an actuarial basis. Benefits are based on a percentage of a participant’s average compensation, including bonuses, for the five calendar years in the ten calendar years prior to the participant’s retirement that produce the highest average compensation, and the participant’s years of credited service. The plan is a continuation of a pension plan that was in effect for former employees of Boise Cascade Corporation. If an employee was a participant in the Boise Cascade plan, his or her benefit under the Company’s plan cannot be less than the benefit he or she would have received under the Boise Cascade plan. The employee’s benefit will be based upon his or her credited service under both the Boise Cascade plan and the Company’s plan. If an employee has seven or more years of credited service under the Boise Cascade plan, part of his or her benefit will be provided by the Boise Cascade plan. The Company’s plan will provide the rest of the total benefit.

-14-

The following table illustrates the estimated annual benefits that would be paid on a straight life annuity basis to a participant in the plan who retired at the plan’s normal retirement date (age 65) for various levels of compensation and years of credited service.

| Years of Credited Service | |||||||||||||||

Final Average Annual Compensation | 10 | 20 | 25 | 30 | 35 | ||||||||||

$200,000 | $ | 25,000 | $ | 50,000 | $ | 62,500 | $ | 75,000 | $ | 87,500 | |||||

300,000 | 37,500 | 75,000 | 93,750 | 112,500 | 131,250 | ||||||||||

400,000 | 50,000 | 100,000 | 125,000 | 150,000 | 175,000 | ||||||||||

500,000 | 62,500 | 125,000 | 156,250 | 187,500 | 218,750 | ||||||||||

600,000 | 75,000 | 150,000 | 187,500 | 225,000 | 262,500 | ||||||||||

700,000 | 87,500 | 175,000 | 218,750 | 262,500 | 306,250 | ||||||||||

800,000 | 100,000 | 200,000 | 250,000 | 300,000 | 350,000 | ||||||||||

900,000 | 112,500 | 225,000 | 281,250 | 337,500 | 393,750 | ||||||||||

| Years of Credited Service | ||||||||||||||||

Final Average Annual Compensation | 10 | 20 | 25 | 30 | 35 | |||||||||||

| $ | 200,000 | $ | 25,000 | $ | 50,000 | $ | 62,500 | $ | 75,000 | $ | 87,500 | |||||

| 300,000 | 37,500 | 75,000 | 93,750 | 112,500 | 131,250 | |||||||||||

| 400,000 | 50,000 | 100,000 | 125,000 | 150,000 | 175,000 | |||||||||||

| 500,000 | 62,500 | 125,000 | 156,250 | 187,500 | 218,750 | |||||||||||

| 600,000 | 75,000 | 150,000 | 187,500 | 225,000 | 262,500 | |||||||||||

| 700,000 | 87,500 | 175,000 | 218,750 | 262,500 | 306,250 | |||||||||||

| 800,000 | 100,000 | 200,000 | 250,000 | 300,000 | 350,000 | |||||||||||

| 900,000 | 112,500 | 225,000 | 281,250 | 337,500 | 393,750 | |||||||||||

As of April 30, 2004,2005, the credited years of service for Messrs. Gosa, Brandt, Blount, Guichard, Sole, and SoleWolk were 13, 34, 27, 11,14, 29, 12, 8, and 7,0, respectively. For determining benefits under the plan, covered compensation for each of these individuals is approximately equal to the sum of the amounts shown in the Summary Compensation Table under the headings “Salary,” “Bonus,” and “LTIP Payouts.”

The Internal Revenue Code limits the total amount of compensation that can be taken into account in computing benefits under the plan, as well as the maximum amount of retirement benefits that may be paid under the plan. These limits are indexed each year, so the ultimate amount of benefit actually paid will depend on the year of retirement. The benefits listed in the table above are not subject to any deductions for social security or other offset amounts. For calendar year 2004,2005, the maximum annual compensation that may be taken into account is $205,000,$210,000, and the maximum annual benefit that may be paid in the form of a single life annuity is $165,000.$170,000.

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee of the Board of Directors is responsible for the establishment of policies and procedures governing executive compensation. The Committee is composed entirely of independent directors.

The Compensation Committee periodically performs a comprehensive review of executive compensation with the assistance of independent compensation consultants. This report summarizes the Committee’s executive compensation philosophy and policies for the Company’s last completed fiscal year.

Compensation Philosophy

The Company’s executive compensation program is designed to assist in attracting, motivating, and retaining qualified senior management. The fundamental objective of the compensation program is to support the achievement of the Company’s business objectives and, thereby, the creation of long-term shareholder value. To this end, the Company’s philosophy is that executive compensation policies should be designed to achieve the following objectives:

-15-

-15-

The Compensation Committee believes that total return to the shareholder should be a major determinant of long-term executive compensation. While a significant portion of compensation may fluctuate with annual results, the total program is structured to emphasize long-term performance and sustained growth in shareholder value.

The Compensation Committee believes base salaries and target incentive compensation for executive management should approximate the averages found in publicly traded peer companies. The Committee further believes a substantial portion of target compensation should be based on Company and individual performance. Actual incentive compensation, therefore, should include elements that result in significant variability based on Company and individual executive performance. Executive management should have an opportunity for superior compensation with superior results. While overall Company performance is emphasized in an effort to encourage and reward teamwork, individual compensation should include some elements which reflect individual responsibilities and contribution. At risk, performance-based compensation averaged approximately 55%44% of total annual cash compensation paid to the executive group during the fiscal year ended April 30, 2004.2005.

The Compensation Committee also believes executives should have a substantial equity ownership position to provide long-term incentives which closely link executive compensation to the Company’s long-term performance and return to shareholders. Such ownership may be accomplished through direct ownership of shares of common stock, awards of options to acquire common stock and other awards based on the performance of common stock.

Competitive Positioning

The Compensation Committee regularly reviews executive compensation levels to ensure the Company will be able to attract and retain the caliber of executives needed to effectively operate the Company, and the pay for executives is reasonable and appropriate relative to current market practice. In making these evaluations, the Compensation Committee annually reviews the results of surveys of executive salary and incentive levels among peer companies and other durable goods manufacturers of similar size. In addition, the Compensation Committee periodically undertakes an analysis of salaries, annual bonuses, and long-term incentives with the assistance of independent compensation consulting firms.

Components of Executive Compensation

The principal components of the Company’s executive compensation program include base salary, annual cash bonus, long-term incentives, and benefits.

Base Salary. Base salaries for all executives have been competitively established based on salaries paid for like positions in comparable companies. The companies used for comparison of base salaries are not necessarily the same companies used in the Performance Graph section of this proxy statement because the Compensation Committee believes the Company’s most direct competitors for executive talent are not necessarily all of the companies included in the peer group used to compare shareholder returns. These salaries are reviewed annually to assure continued competitiveness and are adjusted when necessary. Based on national surveys available to the Compensation Committee and information provided by an independent consultant, the Compensation Committee believes executive management, as a group, is paid at the average market rate. As is the case with the Company’s overall compensation policies for salaried employees, adjustments to executive base salaries result from a demonstrated increase in skills or from market-driven changes in comparable positions.

-16-

Annual Cash Bonus. The purpose of the Company’s annual incentive program is to provide a direct monetary incentive to executives in the form of an annual cash bonus which is tied to the achievement of measurable, predetermined performance objectives. The annual incentive bonus reflects overall Company financial performance. All executive officers are eligible for an annual bonus, with a maximum potential of 100% or 110% of base pay. Senior Vice Presidents of the Company were eligible for a maximum bonus equal to 100% of base pay during the 20042005 fiscal year based on net income (70%) and individual performance (30%). The Chief Executive Officer was eligible for a maximum bonus equal to 110% of base pay during the 20042005 fiscal year based on net income. No annual incentives are paid below certain predetermined levels of minimal performance.

Long-term Incentives. Long-term incentive compensation involves the use of two types of stock-based awards: stock options and shareholder value units. Both types of awards are intended to focus the attention of executives on the achievement of the Company’s long-term performance objectives, to align executive management’s interests with those of shareholders and, in the case of stock options, to facilitate executives’ accumulation of sustained ownership of Company stock. The levels of award opportunities, as combined under both instruments, are intended to be consistent with typical levels of comparable companies and to reflect an individual’s level of responsibility and performance. The companies used for comparison of long-term incentives are not the same companies used in the Performance Graph section of this proxy statement because the Compensation Committee believes that the Company’s most direct competitors for executive talent are not necessarily all of the companies that are included in the peer group used to compare shareholder returns.

Stock options, as awarded under the 1996 and 1999 Stock Option Plans for Employees, and the 2004 Stock Incentive Plan for Employees, give executives the opportunity to purchase common stock for a term not to exceed ten years and at a price of no less than the fair market value of the common stock on the date of grant. Executives benefit from stock options only to the extent the stock price appreciates after the grant of the option. More information concerning option grants made to the named executive officers during the 20042005 fiscal year may be found under the heading “Option Grants in Last Fiscal Year” contained in this Proxy Statement.

Shareholder value units, as awarded under the Shareholder Value Plan for Employees, give executives the opportunity to receive incentive cash payments based on the comparative total return to the shareholders of the Company versus the total returns for a comparable index of peer companies such as the S&P Household Durables Index or the Russell 2000 Index. Executives may be eligible for cash incentives if the Company provides a total return to shareholders that is greater than or equal to the average performance of the index. Additional information concerning Shareholder Value Unit awards may be found under the heading “Long-Term Incentive Plan – Awards in Last Fiscal Year” contained in this Proxy Statement.

Benefits. Benefit programs for executives are designed to provide protection against financial catastrophe that can result from illness, disability, or death. Benefits offered to senior executives are the same as those offered to all employees.

The Company maintains a pension plan for all salaried employees, as described under the heading “Pension Plan” in this Proxy Statement. The Company has also adopted a Pension Restoration Plan. The purpose of this Plan is to restore the level of benefit as defined in the Company’s Pension Plan that may be reduced due to limitations required by the Internal Revenue Service Code. The Plan is a non-qualified, non-contributory plan for a small group of highly compensated employees who are selected for participation in the Plan by the Compensation Committee. Each Plan participant has an account under the Plan to which the Compensation Committee may, in its discretion, credit Company contributions. The amount credited to the accounts of those named executive officers who participated in the Plan in 2004fiscal 2005 is listed under the heading “Summary Compensation Table.” The obligation of the Company to make payments under this Plan is an unsecured promise and any property of the Company set aside for the payment of benefits remains subject to the claims of creditors in the event of the Company’s insolvency until such benefits are distributed to the Plan participants under the provisions of the Plan.

-17-

Compensation of the Chief Executive Officer

The total compensation for the Chief Executive Officer in fiscal 20042005 was established in accordance with the policies discussed above in this report. As reported in the Summary Compensation Table, payments to Mr. Gosa under his base salary increased 10.6%3.1% during the fiscal year based on Mr. Gosa’s performance in fulfilling his responsibilities as President and Chief Executive Officer, and on the Committee’s assessment of comparable positions in similar companies. Mr. Gosa received an annual cash bonus according to the Plan. Mr. Gosa’s stock option award and stock value unit grants were consistent with the Company’s compensation philosophy, and the target value for these incentives is comparable to like positions at similar companies, as determined by an independent compensation consultant. The companies used for these comparisons are not necessarily the same companies used in the Performance Graph section of this proxy statement because the Compensation Committee believes the Company’s most direct competitors for Chief Executive Officer talent are not necessarily all of the companies that are included in the peer group used to compare shareholder returns.

Compliance with Section 162(m) of the Internal Revenue Code

The Company is subject to Section 162(m) of the Internal Revenue Code, which imposes a $1.0 million limit on the amount of compensation that may be deducted by the Company for a taxable year with respect to the Chief Executive Officer and the next four most highly compensated executive officers of the Company. Performance-based compensation that meets certain requirements is not subject to the deduction limit.

The 1996 and 1999 Stock Option Plans for Employees, the 2004 Stock Incentive Plan for Employees, and the Shareholder Value Plan for Employees are designed to comply with the requirements of the performance-based compensation exception from the $1.0 million limit. During fiscal 2004,2005, compensation of the Chief Executive Officer and the next four most highly compensated executive officers under these Plans qualified for the performance-based exception to Section 162(m).

Based on the superior performance of the Company during fiscal 2004, totalTotal compensation of the Chief Executive Officer during 2005 from sources that did not qualify for exemption from the deduction limit exceeded $1.0 million. Both the amount of the compensation over $1.0 million and the amount of the tax deduction lost due to the compensation were immaterial.

The Committee will continue to monitor the impact of the Section 162(m) limit on the Company and to assess alternatives for avoiding the loss of material tax deductions in future years.

James G. Davis, Chairperson

Martha M. Dally Chairperson

James G. Davis

Neil P. DeFeo

Daniel T. Hendrix

-18-

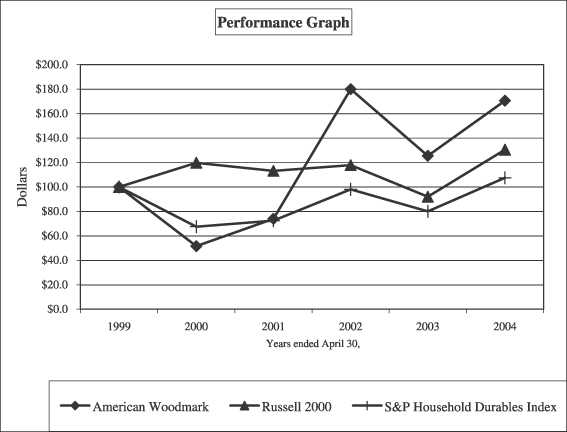

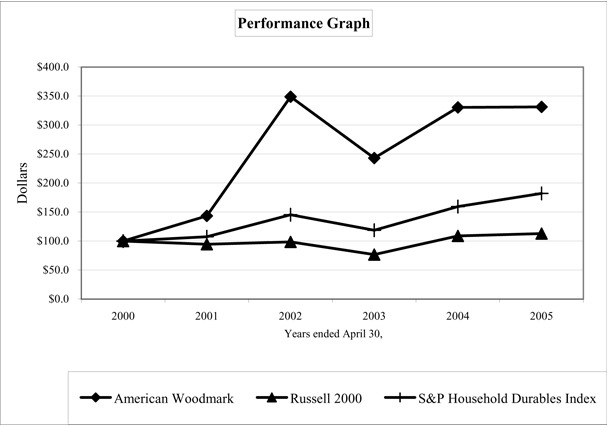

PERFORMANCE GRAPH

Set forth below is a graph comparing the five-year cumulative shareholder return from investing $100 on May 1, 19992000 in American Woodmark Corporation common stock, the Russell 2000 Index, and the S&P Household Durables Index:

CERTAIN TRANSACTIONS

The Company leases its headquarters from Amwood Associates, a partnership including Mr. Brandt and Ms. Stout. The original lease commenced on March 18, 1986 and ended on March 17, 2001. The Company elected to renew this lease in accordance with company policy and procedure which included approval by the Board of Directors for a five-year term which expires in 2006. Current rental payments are $34,974$35,606 per month and are subject to annual increases, not to exceed 7%, based on changes in the Consumer Price Index. During the fiscal year ended April 30, 2004,2005, the Company made aggregate payments under the lease in the amount of $416,000.$420,000. The rent under the lease was established by an independent appraisal and is on terms the Company believes are at least as favorable to the Company as those that could be obtained from unaffiliated third parties.

-19-

STATEMENTS CONCERNING AUDIT SERVICES AND FEES

Changes In Registrant’s Certifying Accountant

On May 19, 2004, the Audit Committee of the Board of Directors of American Woodmark Corporation dismissed Ernst & Young LLP as its independent registered public accounting firm pending completion of its work associated with the audit of financial statements for fiscal year ended April 30, 2004. The dismissal of Ernst & Young LLP was effective on July 14, 2004. On May 19, 2004, the Audit Committee approved the engagement of KPMG LLP as its independent registered public accounting firm to replace the firm of Ernst & Young LLP for the Company’s fiscal year 2005.

The reports of Ernst & Young LLP on the consolidated financial statements of American Woodmark Corporation for the past two fiscal years ended April 30, 2004 and April 30, 2003 did not contain an adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

In connection with the audits of American Woodmark’s financial statements for each of the past two fiscal years ended April 30, 2004 and April 30, 2003 and in the subsequent interim periods, there were no disagreements between American Woodmark Corporation and its auditors, Ernst & Young LLP on any matter of accounting principles or practices, consolidated financial statement disclosure, or auditing scope and procedures, which, if not resolved to the satisfaction of Ernst & Young LLP, would have caused Ernst & Young LLP to make reference to the matter in its reports.

American Woodmark Corporation hasdid not consultedconsult with KPMG LLP during the last two fiscal years ended April 30, 2004 and 2003 or during the subsequent interim periods on either the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on American Woodmark’s consolidated financial statements.

American Woodmark Corporation has provided Ernst & Young LLP with a copy of this disclosure and has requested Ernst & Young LLP to furnish American Woodmark with a letter addressed to the Securities and Exchange Commission stating whether Ernst & Young LLP agreesagreed with the statements made above by American Woodmark. This letter is attached to the Company’s Form 8-K8-K/A filed May 21,July 15, 2004 as Exhibit 16 thereto.

Independent Auditor Fee Information

Fees for professional services provided by our independent auditorsregistered public accounting firm in each of the last two fiscal years, in each of the following categories are:

| 2004 | 2003 | 2005 | 2004 | |||||||||

Audit Fees | $ | 250,000 | $ | 211,000 | $ | 471,000 | $ | 250,000 | ||||

Audit Related | 25,000 | 25,000 | 23,500 | 25,000 | ||||||||

Tax Fees | 20,550 | 9,050 | 4,500 | 20,550 | ||||||||

All Other Fees | 0 | 0 | 0 | 0 | ||||||||

| $ | 295,550 | $ | 245,050 | $ | 499,000 | $ | 295,550 | |||||

Fees for audit services include fees associated with the annual audit and the reviews of the Company’s quarterly reports on Form 10-Q.10-Q and internal control audit required by Sarbanes/Oxley Section 404 regulation. Audit related fees are for employee benefit plan financial statement audits. Tax fees include tax compliance, tax advice, and tax planning.

-20-

Pre-Approval Policies and Procedures

The Audit Committee has adopted a policy that requires advance approval of all audit, audit related, tax services, and other services performed by the independent registered public accounting auditors or consultants.firm. The policy provides for pre-approval by the Audit Committee of specifically defined audit and non-audit services. Unless a specific service has been pre-approved with respect to that year, the Audit Committee must approve the permitted service before the independent auditorregistered public accounting firm or other firm is engaged. The Audit Committee has delegated to the Chair of the Audit Committee authority to approve permitted services provided that the Chair reports any decisions to the Committee at its next scheduled meeting.

ITEM 2 - RATIFICATION OF SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Upon the recommendation of the Audit Committee, the Board of Directors has selected KPMG LLP as independent registered public accounting firm to audit the Financial Statements of the Company for fiscal year 20052006 and has directed a vote of shareholders to be taken to ascertain their approval or disapproval of that selection. If the shareholders do not ratify the selection of KPMG LLP, the Board of Directors will reconsider the selection of the independent registered public accounting firm.

Representatives of KPMG LLP will be present at the Company’s Annual Meeting. Such representatives will have the opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION OF THE SELECTION OF KPMG LLP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR FISCAL YEAR 20052006 (ITEM 2 ON YOUR PROXY CARD).

-21-

ITEM 3 – 20042005 NON-EMPLOYEE DIRECTORS STOCK INCENTIVEOPTION PLAN FOR EMPLOYEES

Introduction

SubjectThere will be presented to shareholder approval, the Board ofannual meeting a proposal that the shareholders approve the 2005 Non-Employee Directors has approved the American Woodmark Corporation 2004 Stock IncentiveOption Plan for Employees (the “Plan”“2005 Directors Plan”). ThisThe 2005 Directors Plan replaces the 2000 Non-Employee Directors Stock Option Plan which terminated on August 31, 2004. The purpose of the 2005 Directors Plan is to attract and retain the services of experienced and qualified non-employee directors of the Company in a way that enhances the identification of those directors’ interest with those interests of the Company’s shareholders. The 2005 Directors Plan is set forth as Appendix B. The following summary of the 2005 Directors Plan is qualified in its entirety by reference to the full textAppendix B.